Algo Trading Strategies 2017 with Autotrading Academy

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Algo Trading Strategies 2017 with Autotrading Academy” below:

Exploring Algo Trading Strategies 2017 with Autotrading Academy

Introduction to Algo Trading in 2017

Algorithmic trading, or algo trading, has significantly transformed financial markets, offering new efficiencies and trading strategies. In 2017, Autotrading Academy introduced cutting-edge algo trading strategies that continue to influence the markets.

What is Algo Trading?

Definition of Algo Trading

Algo trading involves using computer algorithms to execute trades at high speeds and volumes, based on predetermined criteria.

Advantages of Algo Trading

This method offers precision, speed, and efficiency, reducing the impact of human emotions on trading decisions.

Core Principles of Algo Trading

Automated Trading Systems

Overview of how automated systems are designed to monitor and execute trades across multiple markets simultaneously.

Algorithm Development

Discussion on the process of creating effective trading algorithms that can adapt to market conditions.

Algo Trading Strategies from Autotrading Academy

Trend Following Systems

Exploration of algorithms designed to identify and capitalize on market trends.

Arbitrage Opportunities

How algorithms detect price discrepancies across different markets and execute simultaneous trades to gain profit.

2017 Innovations in Algo Trading

Machine Learning Integration

Introduction of machine learning techniques to enhance predictive accuracy and decision-making processes in algorithms.

High-Frequency Trading (HFT) Techniques

Advancements in HFT strategies that allow transactions to be executed within microseconds.

Risk Management in Algo Trading

Volatility Adjustment

Strategies to adjust algorithms in real-time based on market volatility levels.

Backtesting and Optimization

The importance of rigorous backtesting to ensure strategies perform well in various market scenarios.

Regulatory Compliance and Ethical Considerations

Navigating Regulatory Frameworks

Challenges of keeping algorithmic trading systems compliant with global financial regulations.

Ethical Trading Algorithms

Ensuring that trading algorithms operate fairly and transparently to maintain market integrity.

Tools and Technologies Used in Algo Trading

Software and Platforms

Review of the top software and platforms used in 2017 for developing and deploying trading algorithms.

Data Analytics and Management

How big data analytics and management tools play a crucial role in algorithmic trading.

Educational Resources from Autotrading Academy

Courses and Workshops

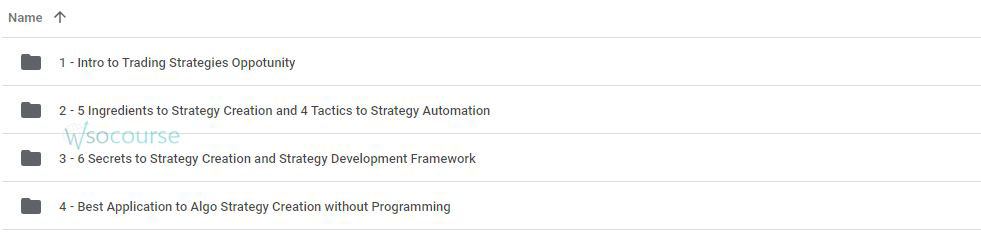

Details on comprehensive courses and workshops offered by Autotrading Academy to train aspiring algo traders.

Webinars and Online Tutorials

Availability of online learning resources to help traders understand and implement advanced algo trading strategies.

Success Stories and Case Studies

Real-World Applications

Examples of successful algo trading strategies implemented in 2017 that yielded high returns.

Lessons Learned

Analyzing the challenges faced and how they were overcome, providing valuable insights for future strategies.

The Future of Algo Trading

Predictions for Technological Advancements

Speculations on future technologies that will shape the next generation of algo trading.

Adapting to Changing Markets

Strategies for algo traders to remain adaptable and competitive in evolving financial markets.

Conclusion

The Autotrading Academy’s algo trading strategies of 2017 have set a benchmark in the finance industry, offering insights and tools that continue to influence trading techniques today. As markets evolve, these strategies remind us of the importance of adaptability and continuous learning in the realm of algorithmic trading.

Frequently Asked Questions:

- What is required to start algo trading?

- A fundamental understanding of financial markets, programming knowledge, and access to algorithmic trading software.

- How can one ensure the security of trading algorithms?

- By implementing robust cybersecurity measures, conducting regular audits, and adhering to best practices in data encryption and secure coding.

- What were some major challenges in algo trading in 2017?

- Issues included handling unexpected market volatility, ensuring regulatory compliance, and managing technological complexities.

- Can algo trading be employed by individual investors?

- Yes, individual investors can use algo trading, but it requires significant investment in technology and a deep understanding of both trading and software development.

- Where can I learn more about algo trading?

- Autotrading Academy, along with various financial education platforms, offers extensive resources for learning about algorithmic trading.

Be the first to review “Algo Trading Strategies 2017 with Autotrading Academy” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

Reviews

There are no reviews yet.