Bond Market Course with The Macro Compass

$499.00 Original price was: $499.00.$15.00Current price is: $15.00.

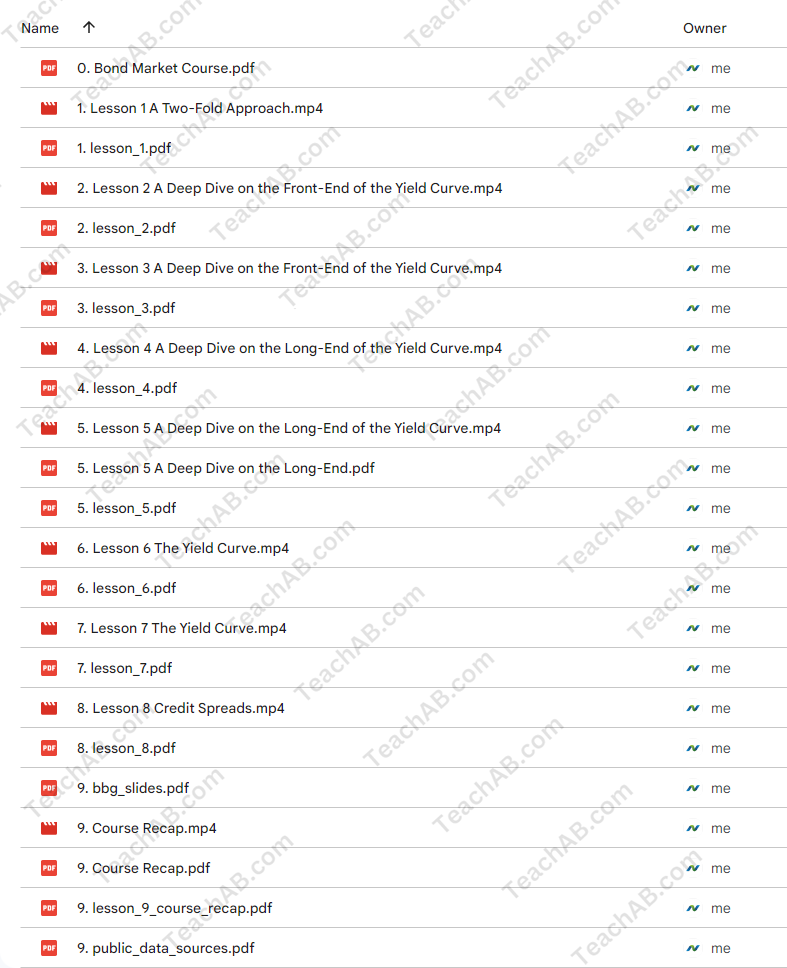

You may check content proof of “Bond Market Course with The Macro Compass ” below:

Course on Bond Markets

Without a thorough understanding of the bond market, macroinvesting is like trying to eat soup with a fork—you can make it, but it’s difficult and unsatisfactory.

Many people are put off by the bond market because of its insider knowledge and language, but that is all changing today with Alf’s Bond Market Course!

Course Synopsis

Lesson 1:

A Dual Method To Truly Comprehend The Bond Market

Your comprehension of the principles underlying bond yields will soar thanks to Alf’s blend of his technical and macro strategies.

Lesson 2+3:

An Extensive Examination of the Yield Curve’s Front End

The front end of the yield curve is where it all begins:

Although central banks have a significant impact on short-term yields, there are other subtleties to take into consideration.

Repo markets, interbank rates, government bonds, OIS, etc.Are you prepared to do it?

Lesson 4+5:

An In-Depth Exam of the Yield Curve’s Long End

Let’s move our attention to the long end of the bond market and examine the factors that influence the world’s largest purchasers’ decisions, the macro factors that influence long-end rates, and how to use bond yields to your advantage when analyzing the macro cycle!

The Yield Curve in Lesson 6-7:

Yes, we have Dr. Yield Curve here! This lesson serves as an introduction to the concepts behind how the yield curve’s structure influences the economic cycle.

Furthermore, we will research every yield curve regime and how it affects other asset classes to make sure your portfolio is always ready for the next big boom!

Lesson 8:

Spreads of Credit

Since credit spreads influence how expensive or inexpensive leverage is for the private sector, they are a crucial macro variable to monitor. We explore the macro and technical facets of credit markets in this lesson!

Course Summary

A brief rundown of all you learned.

Additionally, you’ll get a really helpful collection of slides that walk you through all the (public) data sources so you can monitor all these variables and put all you’ve learned in this bond market course to work!

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable.Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Bond Market Course with The Macro Compass” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.