-

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Awaken The Enlightened Mind (Advanced) by Spirituality Zone

1 × $15.40

Awaken The Enlightened Mind (Advanced) by Spirituality Zone

1 × $15.40 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

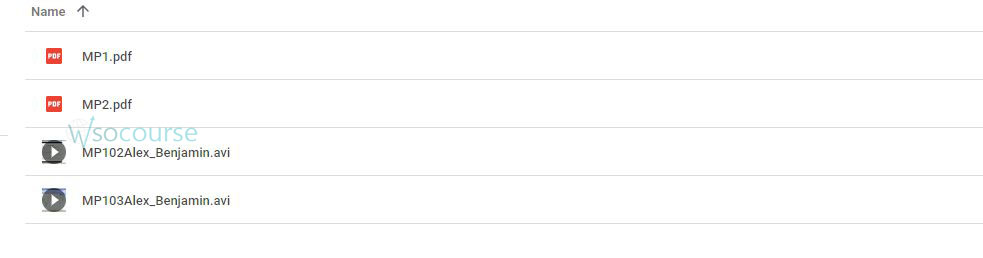

Content Proof: Watch Here!

You may check content proof of “CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin” below:

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

Introduction to CBOT Market Profile Seminar

Welcome to an in-depth exploration of the CBOT Seminar on Market Profile (101 & 102) led by the renowned Alex Benjamin. This seminar is designed to provide a comprehensive understanding of market profile concepts, perfect for both beginners and experienced traders. Let’s delve into what this seminar offers and how it can revolutionize your trading strategies.

What is Market Profile?

Understanding Market Profile

Market Profile is a powerful tool used by traders to analyze and interpret market activity. Developed by J. Peter Steidlmayer, it provides a graphical representation of price distribution over time, helping traders identify key levels of support and resistance.

The Importance of Market Profile in Trading

Market Profile aids in understanding the market’s behavior, enabling traders to make informed decisions. It highlights where the majority of trading occurs, indicating the market’s sentiment and potential future movements.

Overview of CBOT Seminar (101 & 102)

Seminar 101: Foundations of Market Profile

In the first part of the seminar, Alex Benjamin introduces the foundational concepts of Market Profile. This section is crucial for beginners who need to grasp the basics before diving deeper into advanced strategies.

Key Topics Covered in Seminar 101

- Introduction to Market Profile: Understanding the basic structure and components.

- Price-Time Opportunities (PTOs): Learning how PTOs help identify trading opportunities.

- Initial Balance and Range: Analyzing the significance of the initial balance in daily trading.

- Volume at Price (VAP): Exploring the relationship between volume and price levels.

Seminar 102: Advanced Market Profile Techniques

The second part of the seminar takes a deeper dive into advanced Market Profile techniques. Alex Benjamin covers sophisticated strategies that are essential for seasoned traders.

Key Topics Covered in Seminar 102

- Market Profile Patterns: Identifying and interpreting common patterns.

- Value Area Analysis: Using value areas to predict market trends.

- Auction Market Theory: Understanding the principles behind market auctions.

- Trading Strategies: Implementing Market Profile in real-time trading scenarios.

Benefits of Attending the CBOT Seminar

Enhanced Trading Skills

By attending this seminar, traders will enhance their ability to interpret market data, leading to more strategic trading decisions.

Practical Insights from Alex Benjamin

Learning from Alex Benjamin provides practical insights and tips that are not available in textbooks. His expertise and experience offer invaluable knowledge.

Networking Opportunities

The seminar also provides an opportunity to network with fellow traders, share experiences, and learn from each other.

Detailed Breakdown of Seminar Content

Understanding Price-Time Opportunities (PTOs)

PTOs are a fundamental concept in Market Profile. They represent potential trading opportunities based on the interaction between price and time.

Identifying PTOs

- Initial Balance: The range of the first hour of trading.

- Value Area: The price range where 70% of trading activity occurs.

Analyzing Initial Balance and Range

The initial balance can provide critical insights into the market’s direction for the day. A narrow initial balance may indicate a volatile market, while a wide initial balance suggests stability.

Volume at Price (VAP) Analysis

Volume at Price helps traders understand where the majority of trading volume occurs, highlighting significant support and resistance levels.

Advanced Techniques in Seminar 102

Recognizing Market Profile Patterns

Patterns such as the Double Distribution Day and the P-shaped profile provide clues about market sentiment and potential movements.

Applying Auction Market Theory

Auction Market Theory explains the market’s natural tendency to move towards areas of low volume. Traders can use this theory to predict market shifts.

Developing Trading Strategies

Integrating Market Profile into your trading strategy involves:

- Identifying Key Levels: Recognizing support and resistance zones.

- Using Value Areas: Incorporating value areas into your entry and exit points.

- Pattern Recognition: Applying knowledge of Market Profile patterns to anticipate market behavior.

Practical Applications of Market Profile

Real-Time Trading Examples

Alex Benjamin shares real-time trading examples to demonstrate the application of Market Profile techniques.

Case Studies

Case studies of successful trades using Market Profile provide practical insights into effective trading strategies.

Conclusion

Attending the CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin equips traders with essential skills and advanced techniques to excel in the market. By understanding and applying Market Profile concepts, traders can make informed decisions, enhancing their trading performance.

Frequently Asked Questions:

1. What is the primary benefit of using Market Profile in trading?

Market Profile helps traders understand market behavior and identify key levels of support and resistance, leading to more strategic trading decisions.

2. Is the seminar suitable for beginners?

Yes, the seminar is designed for both beginners and experienced traders. Seminar 101 covers foundational concepts, while Seminar 102 delves into advanced techniques.

3. How can I apply Market Profile techniques to my trading strategy?

You can apply Market Profile techniques by identifying key levels, using value areas, and recognizing patterns to anticipate market movements.

4. What are Price-Time Opportunities (PTOs)?

PTOs represent potential trading opportunities based on the interaction between price and time, including concepts like initial balance and value areas.

5. How can I benefit from attending the seminar?

Attending the seminar provides enhanced trading skills, practical insights from Alex Benjamin, and networking opportunities with fellow traders.

Be the first to review “CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.