-

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Ultimate Guide to the Stealth Forex System (stealthforexguide.com)

1 × $6.00

The Ultimate Guide to the Stealth Forex System (stealthforexguide.com)

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Trading Double Diagonals in 2019 with Dan Sheridan – Sheridan Options Mentoring

$297.00 Original price was: $297.00.$5.00Current price is: $5.00.

File Size: 2.11 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

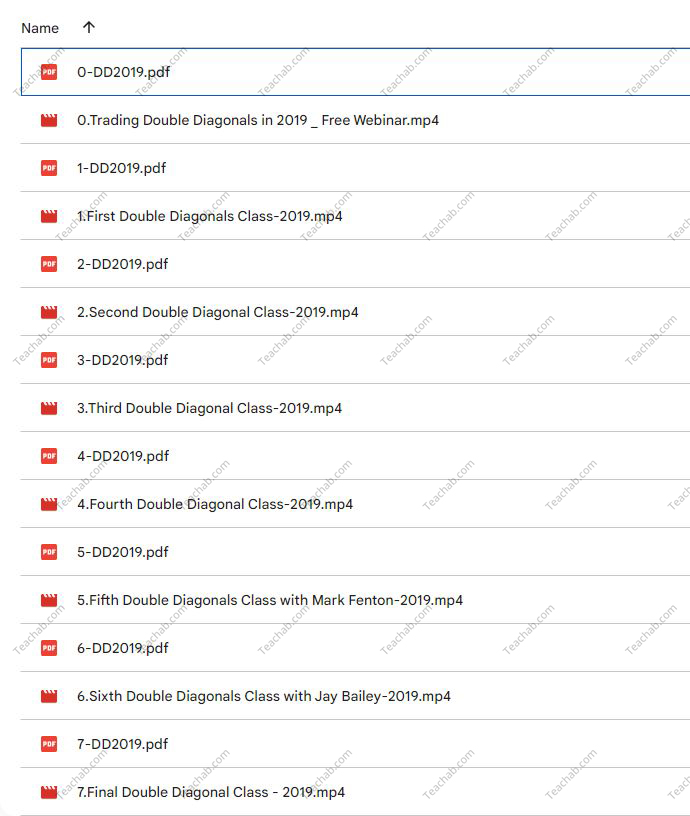

You may check content proof of “Trading Double Diagonals in 2019 with Dan Sheridan – Sheridan Options Mentoring” below:

Mastering Double Diagonals: A 2019 Guide with Dan Sheridan – Sheridan Options Mentoring

Introduction to Double Diagonal Trading

In 2019, the options trading landscape saw numerous strategies rise in popularity, but few offered the flexibility and potential of double diagonals. Dan Sheridan of Sheridan Options Mentoring expertly demystified this approach, providing traders with a comprehensive guide to mastering this advanced strategy.

Who is Dan Sheridan?

Dan Sheridan is a veteran options trader and respected educator in the field. With decades of experience on the CBOE floor, Dan now dedicates his time to mentoring aspiring traders through his comprehensive training programs.

What is Sheridan Options Mentoring?

Sheridan Options Mentoring is a leading educational platform that specializes in teaching sophisticated options trading techniques in a clear and practical manner.

Understanding Double Diagonals

The Basics of Double Diagonals

Double diagonals are an advanced options strategy that involves two diagonal spreads, typically combining both calls and puts to leverage different strike prices and expiration dates.

Why Use Double Diagonals?

This strategy is particularly favored for its ability to capitalize on low-volatility markets while managing risks effectively.

Key Components of a Double Diagonal

Learn about the essential elements that make up a successful double diagonal trade, including strike selection and the importance of expiration timing.

Setting Up a Double Diagonal

Choosing the Right Markets

Insights into selecting the most suitable markets for applying double diagonals, focusing on liquidity and underlying stability.

Timing Your Entry

Strategies for timing your market entry to maximize the effectiveness of double diagonals.

Managing the Greeks

Understanding how ‘the Greeks’ (Delta, Gamma, Theta, Vega) influence double diagonal setups and adjustments.

Risk Management Strategies

Assessing Risk Properly

Techniques to assess and manage the inherent risks associated with double diagonal trading.

Adjustment Techniques

Learn various adjustment strategies to stay profitable under different market conditions.

Exit Strategies

Knowing when to exit is as crucial as entry. Explore practical exit strategies to maximize gains or minimize losses.

Tools and Resources for Double Diagonal Trading

Software Tools

Review of the best software tools for analyzing and setting up double diagonal trades effectively.

Educational Resources from Dan Sheridan

Explore the wealth of educational content Dan Sheridan provides, including webinars, live sessions, and workshops focused on double diagonals.

Real-Time Trading Simulations

The benefits of using real-time trading simulations to practice double diagonal strategies without financial risk.

Integration with Other Trading Strategies

Complementing Your Trading Portfolio

How double diagonals can complement other trading strategies in your portfolio, providing diversification and balance.

Leveraging Market Trends

Tips on leveraging broader market trends to enhance the performance of your double diagonal trades.

Continuous Learning and Adaptation

The importance of ongoing education and how to stay adaptive with evolving market conditions.

Success Stories and Testimonials

Feedback from Traders

Read about how other traders have successfully implemented double diagonal strategies in their trading activities.

Case Studies

Detailed case studies that showcase the real-world application and results of double diagonal trading.

Conclusion

Double diagonal trading, as taught by Dan Sheridan in 2019, remains a relevant and powerful options strategy. Through Dan’s expert guidance and the resources available at Sheridan Options Mentoring, traders can gain the knowledge needed to execute this strategy effectively and confidently.

FAQs

- What exactly is a double diagonal in options trading?

- A double diagonal is an advanced options strategy involving two diagonal spreads with different strike prices and expiration dates.

- Is double diagonal trading suitable for beginners?

- Due to its complexity, double diagonal trading is better suited for traders with some experience in options.

- How important is market volatility for double diagonals?

- Double diagonals generally perform best in low to moderate volatility environments.

- Can double diagonal strategies be automated?

- While certain aspects can be automated, successful double diagonal trading often requires active management and adjustment.

- Where can I learn more about advanced options strategies?

- Sheridan Options Mentoring offers extensive courses and resources on various advanced options strategies, including double diagonals.

Be the first to review “Trading Double Diagonals in 2019 with Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.