Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

$247.00 Original price was: $247.00.$15.00Current price is: $15.00.

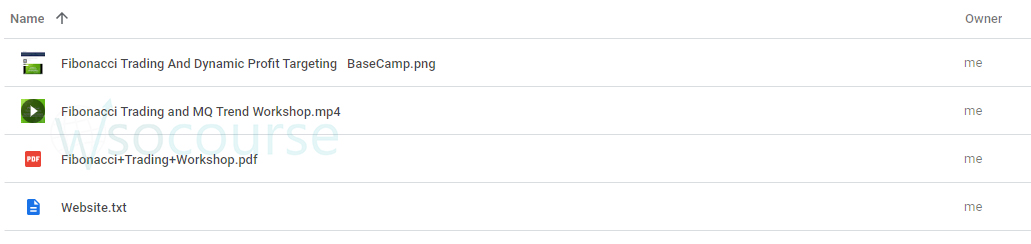

File Size: 488 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading” below:

Unlocking Profit Potential: Mastering Fibonacci Trading & Dynamic Profit Targeting By Base Camp Trading

Introduction: Navigating the World of Fibonacci Trading

Embark on a journey of discovery as we delve into the realm of Fibonacci trading and dynamic profit targeting by Base Camp Trading. In this article, we unravel the mysteries of Fibonacci retracements and extensions, and how they can be harnessed to identify high-probability trading opportunities and maximize profit potential in the markets.

Understanding Fibonacci Trading: Unveiling the Golden Ratio

Fibonacci trading is based on the principle of retracement levels derived from the Fibonacci sequence, a mathematical phenomenon that occurs naturally in various aspects of nature and the financial markets. By applying Fibonacci ratios to price charts, traders can identify key levels of support and resistance, as well as potential reversal points, providing valuable insights into market dynamics.

Exploring Fibonacci Retracements: Finding Support and Resistance

Fibonacci retracements are used to identify potential levels of support and resistance within a price trend. These retracement levels, typically drawn from swing lows to swing highs or vice versa, serve as reference points for traders to anticipate potential price reversals or continuation patterns. Common retracement levels include 38.2%, 50%, and 61.8%, with the 50% level often considered a significant psychological level.

Leveraging Fibonacci Extensions: Projecting Price Targets

Fibonacci extensions are used to project potential price targets beyond the current trend, based on the assumption that price movements tend to exhibit symmetry and proportionality. By measuring the distance of a previous price swing and applying Fibonacci ratios such as 127.2%, 161.8%, and 261.8%, traders can identify areas of interest where price may potentially reverse or continue its trend.

Introducing Dynamic Profit Targeting: Maximizing Profit Potential

Dynamic profit targeting is a strategy employed by Base Camp Trading to adapt profit targets based on market conditions and price action. Rather than using fixed profit targets, dynamic profit targeting adjusts profit levels dynamically based on factors such as volatility, momentum, and support/resistance levels, allowing traders to maximize profit potential while minimizing risk.

Conclusion: Empower Your Trading Journey with Fibonacci Trading & Dynamic Profit Targeting

In conclusion, Fibonacci trading and dynamic profit targeting by Base Camp Trading offer traders a powerful arsenal of tools and strategies to navigate the markets with confidence and precision. By mastering the art of Fibonacci retracements and extensions, and incorporating dynamic profit targeting into their trading approach, traders can unlock the full potential of their trading endeavors and achieve consistent profitability in the markets.

FAQs

- What is the Fibonacci sequence, and how is it used in trading?

- The Fibonacci sequence is a mathematical phenomenon where each number is the sum of the two preceding ones. In trading, Fibonacci ratios derived from this sequence are used to identify key levels of support, resistance, and potential price targets within a price trend.

- How are Fibonacci retracements and extensions applied in trading?

- Fibonacci retracements are used to identify potential levels of support and resistance within a price trend, while Fibonacci extensions are used to project potential price targets beyond the current trend. Both tools are based on Fibonacci ratios and are commonly used by traders to identify high-probability trading opportunities.

- What are the benefits of using dynamic profit targeting in trading?

- Dynamic profit targeting allows traders to adapt profit targets based on market conditions and price action, maximizing profit potential while minimizing risk. By adjusting profit levels dynamically, traders can capture more profit from favorable price movements and protect gains in volatile market conditions.

- How can I incorporate Fibonacci trading and dynamic profit targeting into my trading strategy?

- To incorporate Fibonacci trading into your strategy, start by identifying key levels of support, resistance, and potential price targets using Fibonacci retracements and extensions. Then, integrate dynamic profit targeting by adjusting profit levels based on market conditions and price action.

- Is Fibonacci trading suitable for all markets and timeframes?

- Yes, Fibonacci trading can be applied to various financial markets, including stocks, forex, commodities, and futures, as well as different timeframes, from intraday to long-term trading. The principles of Fibonacci ratios and price symmetry are universal and can be applied across different asset classes and timeframes.

Be the first to review “Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.