Forex Candlestick System. High Profit Forex Trading with B.M.Davis

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

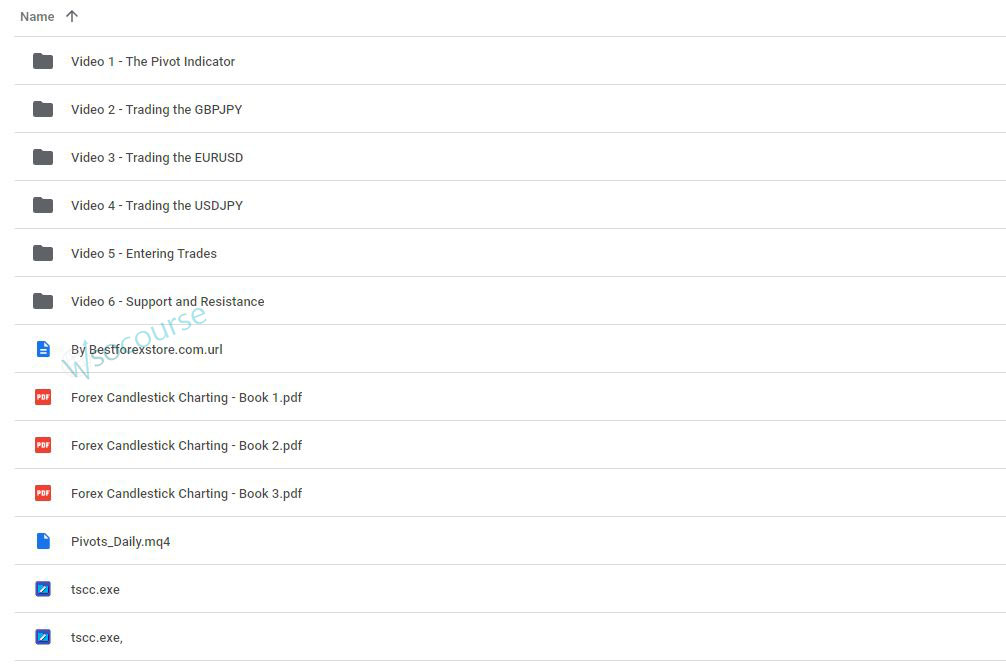

Content Proof: Watch Here!

You may check content proof of “Forex Candlestick System. High Profit Forex Trading with B.M.Davis” below:

High Profit Forex Trading with B.M.Davis

The realm of Forex trading offers vast opportunities for substantial returns, and mastering candlestick patterns is crucial to navigating this volatile market effectively. B.M.Davis, a renowned expert in Forex trading, shares strategies that leverage the power of Forex candlesticks to maximize profits. This comprehensive guide will explore various candlestick formations and their predictive capabilities in currency trading.

Introduction to Forex Candlestick Patterns

Understanding candlestick patterns is essential for any trader looking to gain an edge in the Forex market.

What Are Candlesticks?

Candlesticks are graphical representations of price movements within a specified time frame, offering insights into market sentiment and potential price directions.

The Anatomy of a Candlestick

Each candlestick consists of a body and wicks, indicating the open, close, high, and low prices during the trading period.

Basic Candlestick Patterns

Recognizing basic patterns is the first step to proficient Forex trading.

The Doji

A Doji occurs when the opening and closing prices are virtually equal, representing market indecision.

Bullish and Bearish Engulfing

These patterns signify potential market reversals, where bullish or bearish sentiments overpower previous sentiments.

Advanced Candlestick Patterns

For those looking to deepen their Forex analysis, advanced patterns provide more nuanced insights.

The Morning Star

A bullish reversal pattern that signals the end of a downtrend and the start of an uptrend.

The Evening Star

The opposite of the Morning Star, this pattern suggests a switch from an uptrend to a downtrend.

Candlesticks in Forex Trading Strategies

Integrating candlesticks into trading strategies can significantly enhance decision-making.

Trend Analysis

Using candlesticks to identify and confirm trends is a powerful method for securing profitable trades.

Entry and Exit Points

Candlestick patterns can help traders determine optimal moments to enter or exit trades, maximizing potential profits.

Risk Management with Candlesticks

Effective use of candlestick patterns also involves prudent risk management.

Stop-Loss Orders

Setting stop-loss orders based on candlestick formations can help protect against unforeseen market reversals.

Position Sizing

Adjusting position sizes based on the strength of candlestick signals can mitigate risk while maximizing returns.

Combining Candlesticks with Other Indicators

For best results, candlesticks should be used in conjunction with other technical analysis tools.

Moving Averages

Candlesticks combined with moving averages can confirm trend directions and strength.

RSI and MACD

These indicators, when used with candlestick patterns, can help validate potential buy or sell signals.

Psychological Aspects of Candlestick Trading

Understanding the psychology behind candlestick formations can provide deeper market insights.

Market Sentiment

Candlestick patterns reflect the psychological state of the market, influencing trader behavior.

Trader Behavior

Recognizing common psychological triggers can help predict market movements more accurately.

Conclusion

Forex trading using candlestick systems requires not only understanding the patterns but also integrating them into a comprehensive trading strategy. With insights from B.M.Davis, traders can utilize these patterns to enhance their trading decisions, manage risks effectively, and increase profitability.

Frequently Asked Questions:

- What is the best candlestick pattern for beginners?

The Doji and engulfing patterns are great starting points due to their simplicity and frequency of occurrence. - How reliable are candlestick patterns in Forex trading?

While highly informative, they should be used in conjunction with other analysis tools for best results. - Can candlestick patterns predict market turns?

Yes, patterns like the Morning Star and Evening Star are particularly good at indicating potential reversals. - How important is it to practice candlestick trading in a demo account?

Practicing in a demo account is crucial to gain confidence and refine strategies without financial risk. - What is a common mistake made by traders using candlesticks?

Relying solely on candlesticks without considering market context or other indicators can lead to misinformed decisions.

Be the first to review “Forex Candlestick System. High Profit Forex Trading with B.M.Davis” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex for Profits with Todd Mitchell

Forex for Profits with Todd Mitchell  Essentials in Quantitative Trading QT01 By HangukQuant's

Essentials in Quantitative Trading QT01 By HangukQuant's  Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

Reviews

There are no reviews yet.