-

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Cracking The Forex Code with Kevin Adams

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

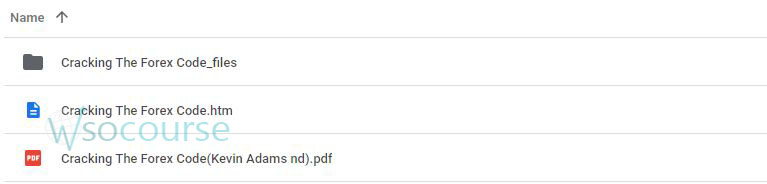

You may check content proof of “Cracking The Forex Code with Kevin Adams” below:

Cracking The Forex Code with Kevin Adams

Navigating the complexities of the Forex market can be daunting, but with Kevin Adams’ guidance, traders can unlock the secrets to successful trading. In this article, we’ll explore the key strategies, insights, and techniques that Adams advocates for mastering Forex trading.

Understanding Forex Trading

Foreign Exchange (Forex) trading involves buying and selling currencies to profit from exchange rate fluctuations. It’s the largest financial market globally, with trillions of dollars traded daily.

Why Trade Forex?

- High Liquidity: The Forex market is highly liquid, allowing for quick transactions.

- 24-Hour Market: Operates 24 hours a day, five days a week.

- Leverage Opportunities: Traders can control large positions with a relatively small amount of capital.

Kevin Adams’ Approach to Forex Trading

Kevin Adams is a seasoned Forex trader known for his systematic and disciplined approach to trading. His methods emphasize risk management, technical analysis, and strategic planning.

Risk Management

Adams stresses the importance of managing risk to ensure long-term success. This includes setting stop-loss orders and not risking more than a small percentage of capital on a single trade.

Technical Analysis

Using charts and technical indicators, Adams analyzes market trends and patterns to make informed trading decisions.

Strategic Planning

A well-defined trading plan is crucial. Adams advises traders to outline their goals, strategies, and risk tolerance before entering the market.

Key Forex Trading Strategies

Trend Following

Trend following involves identifying and trading in the direction of the prevailing market trend.

Tools for Trend Following

- Moving Averages: Help identify the direction of the trend.

- Relative Strength Index (RSI): Indicates overbought or oversold conditions.

Swing Trading

Swing trading aims to capture short-to-medium-term gains by taking advantage of market swings.

Steps for Swing Trading

- Identify Swing Points: Look for high and low points in the market.

- Use Technical Indicators: Tools like MACD and Bollinger Bands can help confirm swing points.

- Set Entry and Exit Points: Determine where to enter and exit trades based on market analysis.

Scalping

Scalping involves making numerous small trades throughout the day to capitalize on minor price movements.

Scalping Tips

- Focus on Liquid Markets: Higher liquidity ensures quick execution of trades.

- Use Tight Spreads: Lower spreads reduce trading costs.

- Stay Disciplined: Stick to the trading plan and avoid overtrading.

Technical Indicators and Tools

Moving Averages

Moving averages smooth out price data to identify trends over a specific period.

Bollinger Bands

Bollinger Bands consist of a moving average and two standard deviations, indicating market volatility.

Fibonacci Retracement

Fibonacci retracement levels help identify potential support and resistance levels in the market.

Forex Trading Platforms

Choosing the right trading platform is essential for executing trades efficiently.

Features to Look For

- User-Friendly Interface: Easy navigation and execution.

- Real-Time Data: Access to up-to-date market information.

- Technical Analysis Tools: Built-in charting tools and indicators.

Developing a Forex Trading Plan

A comprehensive trading plan should include:

Trading Goals

Clearly define your short-term and long-term trading goals.

Risk Management

Determine your risk tolerance and set appropriate stop-loss and take-profit levels.

Trading Strategies

Outline the strategies you will use and under what conditions you will apply them.

Review and Adapt

Regularly review your trading performance and adapt your plan as needed.

Common Forex Trading Mistakes

Overleveraging

Using too much leverage can amplify losses. It’s crucial to use leverage wisely.

Lack of Discipline

Sticking to a trading plan and not letting emotions drive decisions is key to success.

Ignoring Risk Management

Failing to manage risk can lead to significant losses. Always use stop-loss orders and manage position sizes.

Advantages of Forex Trading

High Liquidity

The Forex market’s high liquidity ensures that trades can be executed quickly and efficiently.

Low Transaction Costs

Lower transaction costs compared to other markets make Forex trading more cost-effective.

Flexibility

The 24-hour nature of the Forex market allows traders to trade at any time, offering greater flexibility.

Conclusion

Cracking the Forex code with Kevin Adams involves understanding the market, employing effective strategies, and maintaining disciplined risk management. By following Adams’ approach, traders can navigate the Forex market more confidently and increase their chances of success.

FAQs

1. What is Forex trading?

Forex trading involves buying and selling currencies to profit from exchange rate fluctuations.

2. Why is risk management important in Forex trading?

Risk management helps protect capital and ensures long-term trading success by limiting potential losses.

3. What are some common Forex trading strategies?

Common strategies include trend following, swing trading, and scalping.

4. How can technical analysis help in Forex trading?

Technical analysis uses charts and indicators to identify market trends and make informed trading decisions.

5. What should a Forex trading plan include?

A Forex trading plan should include trading goals, risk management strategies, and detailed trading strategies.

Be the first to review “Cracking The Forex Code with Kevin Adams” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.