-

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

$588.00 Original price was: $588.00.$15.00Current price is: $15.00.

File Size: 3.31 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

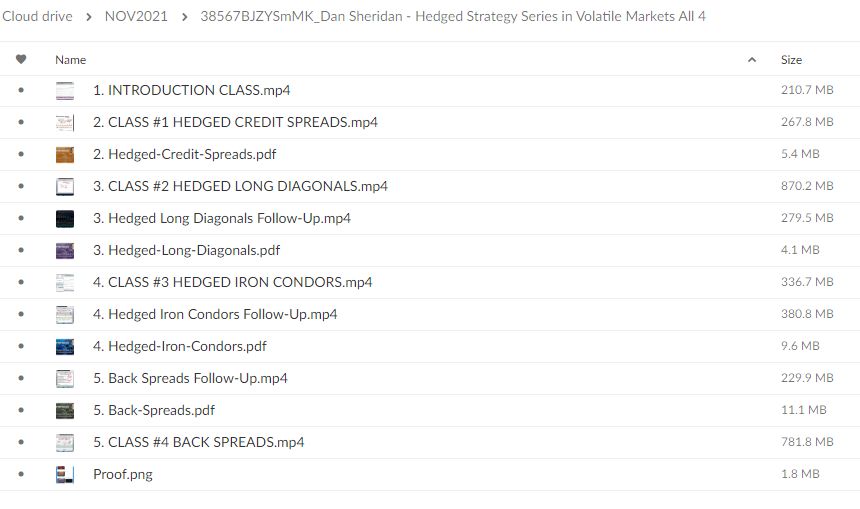

You may check content proof of “Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan” below:

Hedged Strategy Series in Volatile Markets: All 4 with Dan Sheridan

Introduction: Navigating Turbulence with Strategy

In the whirlwind of volatile markets, traders and investors seek stability and profit through well-crafted strategies. Dan Sheridan’s Hedged Strategy Series offers a beacon of wisdom for those aiming to navigate these choppy waters effectively. Let’s explore these strategies and see how they can fortify your trading arsenal.

Understanding the Basics of Hedged Strategies

What is a Hedged Strategy?

At its core, a hedged strategy involves using financial instruments to offset potential losses in investments. It’s akin to having an insurance policy for your trades.

Why Use Hedged Strategies in Volatile Markets?

- Risk Reduction: Minimizes potential losses during unexpected market movements.

- Profit Potential: Allows traders to capitalize on market volatility without excessive risk.

The Four Pillars of Sheridan’s Strategy

Strategy 1: Protective Puts

This strategy involves buying put options to safeguard against a decline in the stock price. It’s like an airbag for your stock investments—deploying protection when things go south.

Strategy 2: Covered Calls

Selling call options against a stock position can generate income and provide a slight buffer against price decreases. Think of it as setting a safety net where you can catch some gains even if the stock slips a bit.

Strategy 3: Iron Condors

This strategy uses four different options to capitalize on stocks trading in a narrow range during high volatility. It’s like playing both sides of the field, ensuring you score whether the market swings up or down.

Strategy 4: Butterfly Spreads

Utilizing both calls and puts, this strategy thrives on minimal movement in the underlying stock. It’s designed to capture gains from small market moves, much like a butterfly delicately landing on targets.

Tools and Resources for Hedging

Essential Tools for Implementing Hedged Strategies

To effectively use these strategies, traders need tools that provide real-time data and analytics. Platforms like Thinkorswim and Interactive Brokers are invaluable for these tasks.

Real-World Application: Learning from Dan Sheridan

Sheridan’s Approach to Teaching

Dan Sheridan emphasizes the importance of education in trading. His approach is not just about strategies but also understanding the market’s nature, helping traders make informed decisions.

Conclusion: Mastering Market Volatility

With Dan Sheridan’s Hedged Strategy Series, traders can approach volatile markets with confidence. These strategies, when applied correctly, offer a way to manage risk while maintaining the potential for profit.

FAQs

What are hedged strategies in trading?

Hedged strategies involve using financial instruments to offset potential losses in investments, similar to insurance for trades.

Why are these strategies beneficial in volatile markets?

They reduce risk and allow traders to profit from market volatility safely.

Can beginners implement these strategies?

Yes, with proper education and the right tools, even beginners can apply hedged strategies effectively.

What tools does Dan Sheridan recommend for trading?

Sheridan often suggests using platforms like Thinkorswim for their robust analytics and real-time data capabilities.

How do these strategies help in risk management?

By providing protective measures against market downturns and allowing for gains in various market conditions, these strategies enhance risk management.

Be the first to review “Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.