Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

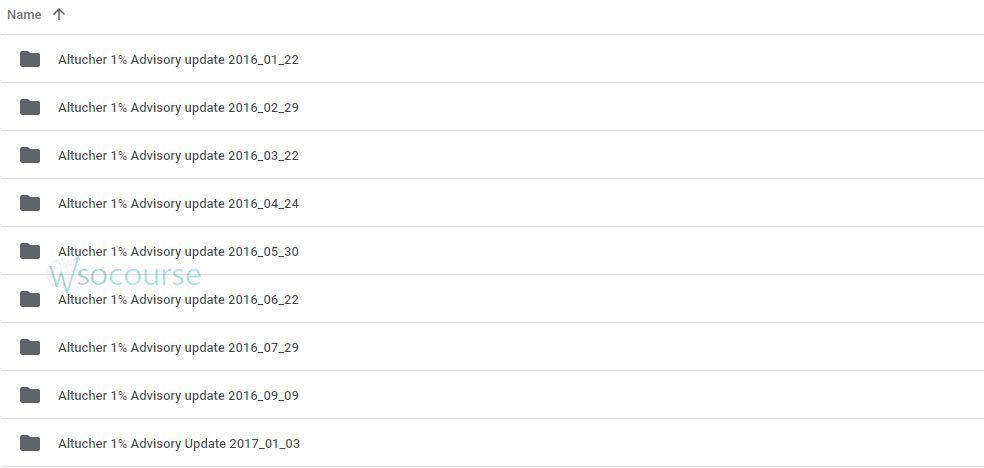

You may check content proof of “Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher” below:

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

Introduction

When it comes to investment advice, few voices are as distinctive and insightful as James Altucher’s. In 2016, his Top 1% Advisory newsletter promised to open the door to elite investment opportunities, traditionally reserved for the wealthiest investors. Let’s dive into what made this newsletter a noteworthy guide for investors seeking unique, high-yield opportunities.

What is the Top 1% Advisory Newsletter?

James Altucher’s Top 1% Advisory is a subscription-based newsletter that aims to provide subscribers with high-level investment advice. It focuses on opportunities that are often out of reach for the average investor, sourcing ideas from hedge funds, venture capital, and insider connections that James himself has cultivated over years in the finance industry.

Key Features of the 2016 Edition

- Exclusive Investment Opportunities: Access to startup deals, insider trades, and more.

- Monthly Recommendations: Detailed investment recommendations each month.

- Direct Access to Experts: Interviews and Q&A sessions with industry leaders.

Why It Matters

Investors are always seeking an edge, and Altucher’s newsletter offered just that. By breaking down complex investment strategies and highlighting under-the-radar opportunities, it provided actionable advice that could potentially lead to significant financial gains.

A Focus on Unconventional Wisdom

Altucher’s philosophy often goes against the grain, advocating for strategies not commonly found in mainstream financial advice. This approach resonates with those who are looking for alternative ways to grow their wealth.

The Unique Selling Proposition of the Newsletter

The main appeal of the Top 1% Advisory lies in its exclusivity and the quality of its insights. Subscribers get more than just investment tips; they receive a comprehensive education in wealth-building strategies employed by the richest investors.

Insider Knowledge

With his extensive network, Altucher is able to bring insights that are typically hidden from public view, giving subscribers a ‘behind-the-curtain’ look at the financial world.

Success Stories and Testimonials

Numerous subscribers have reported success from following the advice provided in the newsletter, with some achieving substantial returns on their investments, which they attribute directly to Altucher’s recommendations.

A Community of Like-Minded Investors

Subscribers also benefit from becoming part of a community that shares insights and strategies, further enriching the investment learning process.

Challenges and Critiques

While many find value in the newsletter, it’s not without its critics. Some argue that the high-risk nature of some recommended investments may not be suitable for all investors.

Navigating the Risks

Understanding and managing risk is a significant part of the advice Altucher gives, emphasizing that not all recommendations will suit every investor’s risk profile.

How to Maximize the Benefits of the Newsletter

To truly benefit from the Top 1% Advisory, subscribers should combine Altucher’s advice with their own research, tailoring strategies to fit their individual financial situations and goals.

Engaging with Content

Actively engaging with the newsletter’s content—questioning, analyzing, and applying the advice—can lead to more informed investment decisions.

Conclusion

James Altucher’s Top 1% Advisory Newsletter from 2016 stands as a testament to innovative financial thinking. For those willing to explore unconventional investment avenues, it offers a treasure trove of insights and strategies that promise more than just financial returns; they offer a new perspective on wealth and investing.

FAQs

- What type of investments did the newsletter focus on?

- The newsletter primarily focused on investments in startups, cryptocurrencies, and unique stock market opportunities.

- How often was the newsletter published?

- It was a monthly newsletter, providing new insights and opportunities in each edition.

- Was the newsletter suitable for novice investors?

- While valuable, the newsletter was best suited for those with some investment experience due to the complexity and risk of the recommended strategies.

- Could international subscribers access the newsletter?

- Yes, it was available internationally, with relevant advice for global markets.

- How has the newsletter evolved since 2016?

- The newsletter has continuously adapted, incorporating new technologies and strategies to stay relevant in the changing financial landscape.

Be the first to review “Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Ultimate Trading Course with Dodgy's Dungeon

Ultimate Trading Course with Dodgy's Dungeon  The Trading Blueprint with Brad Goh - The Trading Geek

The Trading Blueprint with Brad Goh - The Trading Geek  The Best Option Trading Course with David Jaffee - Best Stock Strategy

The Best Option Trading Course with David Jaffee - Best Stock Strategy  Bond Market Course with The Macro Compass

Bond Market Course with The Macro Compass

Reviews

There are no reviews yet.