Staying Alive in the Markets (Video & Manual) with Mark Cook

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

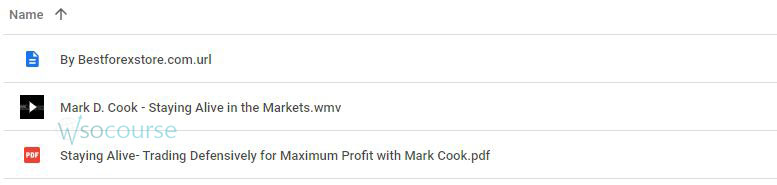

Content Proof: Watch Here!

You may check content proof of “Staying Alive in the Markets (Video & Manual) with Mark Cook” below:

Staying Alive in the Markets (Video & Manual) with Mark Cook

Introduction

Navigating the financial markets can be a treacherous journey, filled with volatility and uncertainty. Mark Cook, an experienced trader and educator, offers valuable insights through his “Staying Alive in the Markets” video and manual. This guide aims to equip traders with the necessary tools and strategies to survive and thrive in the ever-changing market landscape. Let’s dive into Cook’s teachings and explore how you can enhance your trading skills and stay afloat in the markets.

Understanding Market Survival

The Importance of Market Survival

Surviving in the markets is not just about making profits but also about protecting your capital and minimizing losses. Mark Cook emphasizes the need for a robust strategy that balances risk and reward.

Key Elements of Market Survival

- Risk Management

- Emotional Discipline

- Continuous Learning

Mark Cook’s Approach to Market Survival

1. Comprehensive Risk Management

Setting Realistic Goals

Cook stresses the importance of setting realistic trading goals. This includes defining acceptable levels of risk and potential returns.

Implementing Stop-Loss Orders

Using stop-loss orders can help limit potential losses, ensuring that a single trade does not jeopardize your entire portfolio.

2. Developing Emotional Discipline

Sticking to the Plan

A well-defined trading plan is crucial. Cook advises traders to stick to their plan and avoid making impulsive decisions based on short-term market movements.

Managing Stress

Effective stress management techniques, such as mindfulness and regular exercise, can help traders stay calm and make rational decisions.

3. Embracing Continuous Learning

Staying Informed

Keeping up with market trends and economic news is essential. Cook recommends regular reading and staying informed about global financial developments.

Seeking Guidance

Learning from experienced traders and mentors, like Mark Cook, provides valuable insights and helps avoid common pitfalls.

Practical Tips from the Video & Manual

1. Building a Robust Trading Plan

Setting Clear Objectives

Define specific, achievable objectives for your trading activities. This includes profit targets and acceptable loss limits.

Regular Review and Adjustment

Regularly reviewing and adjusting your trading plan based on performance and market conditions is crucial for long-term success.

2. Implementing Effective Risk Management

Using Stop-Loss Orders

Stop-loss orders automatically sell a security when it reaches a predetermined price, limiting potential losses and protecting your capital.

Diversifying Investments

Diversifying your investments across various assets can reduce risk and protect your portfolio from significant losses.

3. Enhancing Emotional Control

Avoiding Overtrading

Overtrading can lead to increased transaction costs and emotional exhaustion. Stick to your plan and avoid unnecessary trades.

Practicing Patience

Patience is key in trading. Waiting for high-probability opportunities can help you avoid impulsive decisions and potential losses.

4. Continuous Education and Adaptation

Staying Updated with Market Trends

Regularly updating your knowledge about market trends and economic developments helps you make informed trading decisions.

Learning from Mistakes

Analyzing past trades and learning from mistakes can help you improve your strategies and enhance your trading performance.

The Psychological Aspect of Trading

1. Building Resilience

Developing a Positive Mindset

Maintaining a positive mindset despite losses is crucial. Focus on long-term goals and view each loss as a learning opportunity.

Stress Management Techniques

Practicing stress management techniques can help traders stay calm and make rational decisions during stressful times.

2. Learning from Past Experiences

Analyzing Past Trades

Regularly reviewing past trades to identify mistakes and areas for improvement is crucial for growth.

Adapting Strategies

Adjusting strategies based on lessons learned from past mistakes helps enhance overall trading performance.

Conclusion

“Staying Alive in the Markets” by Mark Cook provides traders with essential strategies and insights to navigate the complexities of the financial markets. By emphasizing risk management, emotional discipline, and continuous learning, Cook’s teachings can help you survive and thrive in the markets. Remember, the key to market survival is not just about making profits but also about protecting your capital and learning from your experiences.

FAQs

1. What is the main focus of “Staying Alive in the Markets”?

The main focus is on providing traders with strategies to survive and thrive in the financial markets by emphasizing risk management, emotional discipline, and continuous learning.

2. How can stop-loss orders help in trading?

Stop-loss orders help limit potential losses by automatically selling a security when it reaches a predetermined price, protecting your capital.

3. Why is emotional discipline important in trading?

Emotional discipline helps traders avoid impulsive decisions driven by fear or greed, ensuring they stick to their trading plan and make rational choices.

4. What are the benefits of diversifying investments?

Diversifying investments across various assets can reduce risk and protect your portfolio from significant losses.

5. How can continuous learning benefit traders?

Continuous learning keeps traders informed about market trends and strategies, enabling them to adapt and improve their trading performance over time.

Be the first to review “Staying Alive in the Markets (Video & Manual) with Mark Cook” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.