Module II – Signature Trades with FX MindShift

$499.00 Original price was: $499.00.$6.00Current price is: $6.00.

File Size: 988 MB

Delivery Time: 1–12 hours

Media Type: Online Course

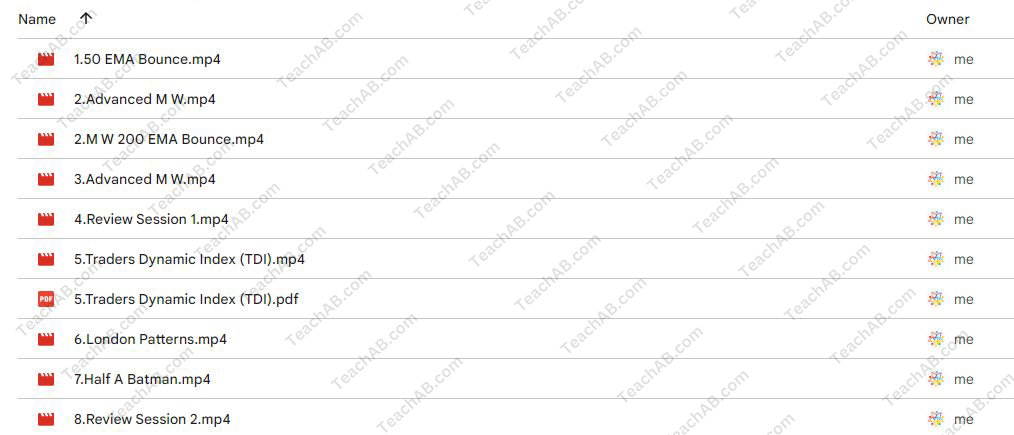

Content Proof: Watch Here!

You may check content proof of “Module II – Signature Trades with FX MindShift” below:

Module II – Signature Trades with FX MindShift

Introduction to Signature Trades

In Module II of the FX MindShift series, we explore the concept of Signature Trades, a strategy that can significantly enhance a trader’s ability to identify and execute profitable transactions in the forex market.

Understanding Signature Trades

What Are Signature Trades?

Signature trades are unique, high-probability trading setups that align with a trader’s specific strategy, skill set, and risk management rules, cultivated through rigorous analysis and experience.

Importance of Signature Trades in Forex

Signature trades offer a strategic edge by leveraging patterns and market behaviors that have consistently yielded positive results.

Developing Your Signature Trading Strategy

Identifying Your Trading Style

Understand whether your strengths lie in scalping, day trading, swing trading, or position trading, and how this affects your signature trade approach.

Analyzing Market Conditions

- Bullish Setups: Identifying scenarios for potential long positions.

- Bearish Setups: Recognizing opportunities to go short.

Technical Analysis for Signature Trades

Chart Patterns

Learn to recognize and interpret key chart patterns that frequently lead to successful trades.

Technical Indicators

- Moving Averages

- MACD (Moving Average Convergence Divergence)

- RSI (Relative Strength Index)

The Role of Fundamental Analysis

Economic Indicators

How economic releases can affect your trading setups and the timing of your signature trades.

Market Sentiment

Utilizing market sentiment to gauge potential moves and trader behavior.

Risk Management in Signature Trades

Setting Stop-Loss Orders

Learn the importance of protecting your capital with well-placed stop-loss orders.

Managing Trade Size

Understanding the significance of position sizing in maintaining portfolio balance.

Backtesting Signature Trades

Historical Data Analysis

The benefits of backtesting your signature trades to refine accuracy and improve confidence.

Adjusting Strategies Based on Backtest Results

How to tweak and improve your strategies based on historical performance.

Live Market Application

Real-Time Trading

Applying signature trades in live market conditions to understand the dynamics and execution challenges.

Adapting to Market Changes

How to stay flexible and adjust your signature trades as market conditions evolve.

Learning from the Experts

Case Studies from FX MindShift

Insights into how seasoned traders at FX MindShift utilize their own signature trades.

Guest Speakers

Experienced traders share their journey and tips on developing successful signature trades.

Building Confidence Through Practice

Simulated Trading Environments

Utilize FX MindShift’s simulated trading platforms to practice without financial risk.

Feedback and Improvement

How constructive feedback from trading simulations can lead to improved trading performance.

Community and Ongoing Support

Joining FX MindShift’s Trading Community

Benefits of engaging with a community of like-minded traders for support and continuous learning.

Access to Continuous Learning Resources

Ongoing educational materials and updates to keep your trading skills sharp and up-to-date.

Conclusion

Module II of the FX MindShift series empowers traders to develop, refine, and execute their own signature trades. By understanding and implementing the strategies discussed, traders can enhance their potential for success in the competitive world of forex trading.

FAQs About Signature Trades with FX MindShift

- Can signature trades be applied to any financial market?

Yes, while tailored for forex, the concepts can be adapted to equities, commodities, and more.

2. How long does it take to develop a reliable signature trade?

Developing a reliable signature trade can take several months of analysis, backtesting, and live trading.

3. What is the minimum capital required to start trading signature trades?

This can vary, but traders can start with a modest amount, typically from $1,000, depending on broker requirements.

4. Are there any specific tools required to identify signature trades?

Basic trading platforms usually provide sufficient tools, though advanced software may offer more in-depth analysis capabilities.

5. How does FX MindShift support traders in refining their signature trades?

FX MindShift offers detailed analytical tools, educational resources, and expert mentorship to help traders refine their strategies.

Be the first to review “Module II – Signature Trades with FX MindShift” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.