-

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Trading for a Living with Alexander Elder

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

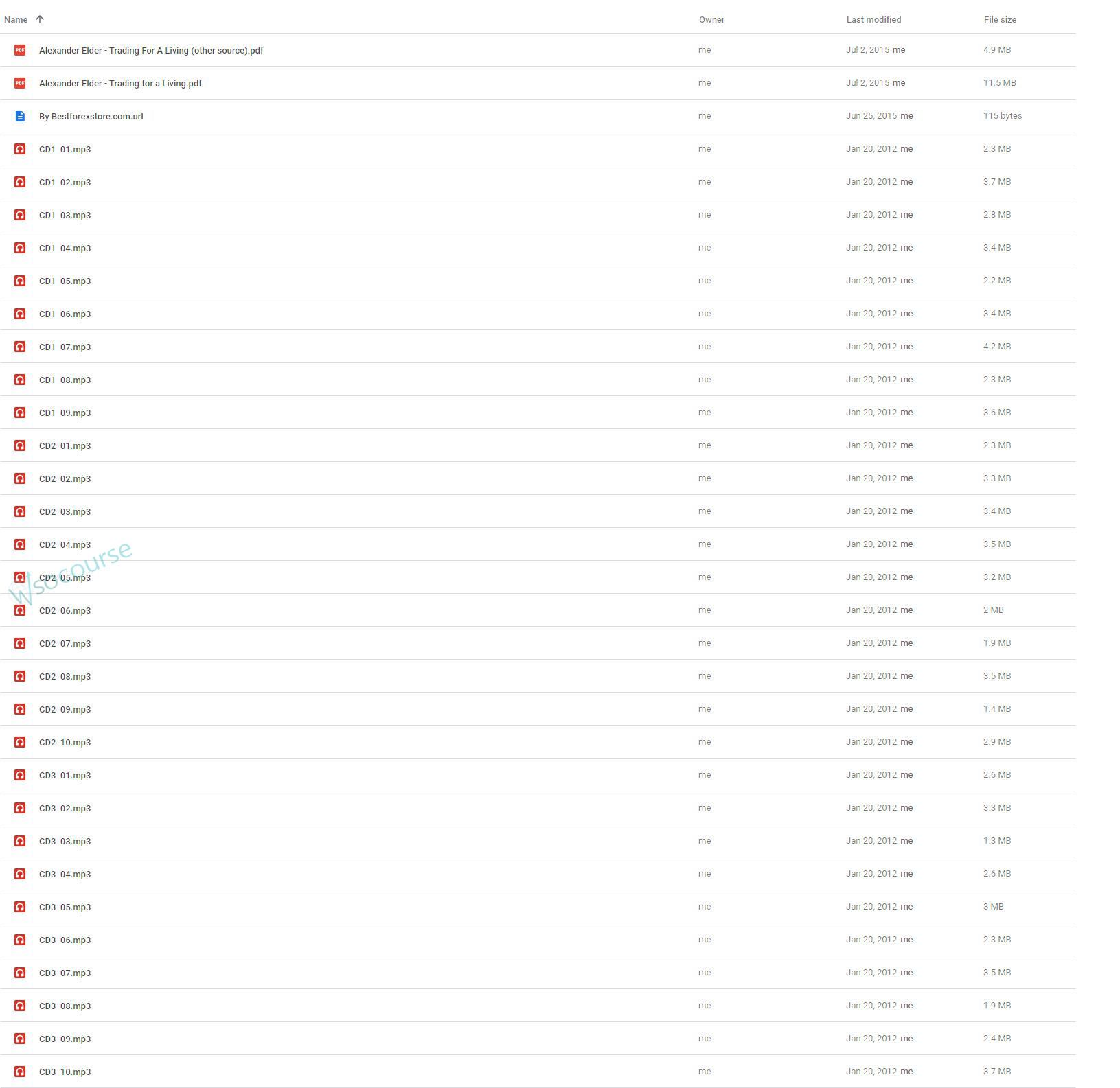

You may check content proof of “Trading for a Living with Alexander Elder” below:

Trading for a Living with Alexander Elder

Introduction

Trading for a living is a dream for many, but it’s a challenging endeavor that requires discipline, strategy, and psychological fortitude. Alexander Elder, a renowned trader and author, provides invaluable insights into making this dream a reality in his book, “Trading for a Living.” This article explores Elder’s principles and strategies to help you transition from a casual trader to a professional one.

Who is Alexander Elder?

Background and Expertise

Dr. Alexander Elder, originally a psychiatrist, brings a unique psychological perspective to trading. His understanding of human behavior and emotions gives him a distinct advantage in the world of trading.

Notable Works

Elder is best known for his books “Trading for a Living,” “Come Into My Trading Room,” and “Sell & Sell Short.” These works have become essential resources for traders seeking comprehensive guidance on both the technical and psychological aspects of trading.

The Concept of Trading for a Living

What Does It Mean?

Trading for a living means relying on trading as your primary source of income. This requires consistent profitability, effective risk management, and a disciplined approach.

Challenges Involved

- Income Stability: Unlike a regular job, trading income can be highly variable.

- Emotional Stress: The pressure of having to earn a living can affect decision-making.

- Continuous Learning: Markets evolve, and so must your strategies and knowledge.

Developing a Trading Plan

Importance of a Trading Plan

A well-structured trading plan is essential for success. It provides a roadmap and helps maintain discipline and consistency.

Components of a Trading Plan

- Goals: Define clear, achievable objectives.

- Strategies: Detail the methods and tools you will use.

- Risk Management: Outline how you will protect your capital.

- Evaluation: Regularly review and adjust your plan based on performance.

Technical Analysis Techniques

Chart Patterns

Understanding chart patterns is crucial for predicting market movements. Key patterns include:

- Head and Shoulders

- Double Tops and Bottoms

- Triangles

Indicators

Technical indicators help in making informed decisions. Essential indicators are:

- Moving Averages

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

Fundamental Analysis

Why It Matters

While technical analysis focuses on price movements, fundamental analysis evaluates the underlying factors that influence a security’s value.

Key Elements

- Economic Indicators: Interest rates, employment data, and GDP.

- Company Financials: Earnings reports, balance sheets, and cash flow statements.

Risk Management Strategies

The Importance of Risk Management

Protecting your capital is paramount. Effective risk management ensures long-term sustainability in trading.

Techniques

- Position Sizing: Determine how much to invest in each trade.

- Stop-Loss Orders: Pre-set points to exit a losing trade.

- Diversification: Spread investments across different assets to minimize risk.

Psychological Aspects of Trading

Emotional Discipline

Maintaining emotional discipline is critical. Traders must manage emotions like fear and greed to make rational decisions.

Tools for Psychological Control

- Trading Journal: Documenting trades and emotions helps identify patterns and improve decision-making.

- Meditation: Helps in maintaining mental clarity and focus.

- Self-Assessment: Regularly evaluate personal strengths and weaknesses.

Daily Routine of a Professional Trader

Pre-Market Preparation

- Market Analysis: Review overnight market movements and news.

- Strategy Review: Revisit your trading plan and strategies for the day.

- Setting Goals: Define specific targets for the trading session.

Trading Hours

- Focus and Discipline: Stick to your plan and avoid impulsive trades.

- Monitoring Trades: Keep a close watch on active trades and market conditions.

Post-Market Review

- Performance Analysis: Review trades to identify successes and areas for improvement.

- Journaling: Document the day’s activities and emotional state.

Tools and Resources

Trading Platforms

Choosing the right platform is crucial. Consider:

- User Interface: Ease of use and functionality.

- Analytical Tools: Availability of charts and indicators.

- Order Execution: Speed and reliability of trade execution.

Educational Resources

Continuous learning is vital. Elder recommends:

- Books: Stay updated with the latest trading literature.

- Webinars: Participate in online seminars and workshops.

- Forums: Engage with trading communities for insights and support.

Practical Examples

Case Study: Consistent Trader

A trader follows Elder’s principles, developing a structured plan and employing disciplined strategies. Over time, the trader achieves consistent profitability and successfully trades for a living.

Case Study: Overcoming Challenges

A trader faces emotional and financial challenges but overcomes them by implementing Elder’s psychological and risk management tools.

Conclusion

Trading for a living, as outlined by Alexander Elder, requires a disciplined approach, effective strategies, and emotional resilience. By following Elder’s guidance, traders can transition from part-time to full-time trading, achieving financial independence and long-term success.

FAQs

1. What is the main focus of “Trading for a Living” by Alexander Elder?

The book focuses on the strategies and psychological aspects necessary for consistent trading success.

2. Why is risk management crucial in trading?

Risk management protects your capital and ensures long-term sustainability, preventing significant losses.

3. How can one maintain emotional discipline while trading?

Using tools like trading journals, meditation, and self-assessment can help manage emotions and make rational decisions.

4. What are the key components of a trading plan?

A trading plan should include goals, strategies, risk management techniques, and regular evaluation.

5. How does fundamental analysis complement technical analysis?

Fundamental analysis evaluates underlying factors influencing a security’s value, providing a comprehensive trading approach.

Be the first to review “Trading for a Living with Alexander Elder” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.