Trading For Busy People with Josias Kere

$29.00 Original price was: $29.00.$6.00Current price is: $6.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

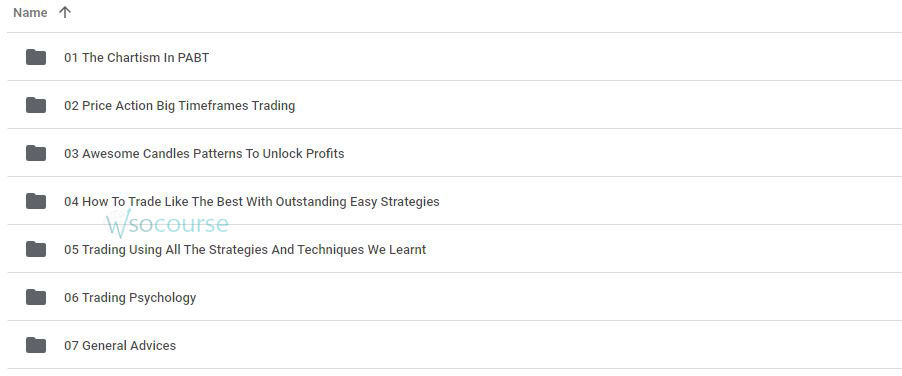

Content Proof: Watch Here!

You may check content proof of “Trading For Busy People with Josias Kere” below:

Trading For Busy People with Josias Kere

Introduction to Trading for Busy People

In today’s fast-paced world, finding time to manage investments can be challenging. Josias Kere, a seasoned trader and financial expert, provides valuable insights into how busy individuals can effectively engage in trading without sacrificing their time.

Who is Josias Kere?

A Brief Biography

Josias Kere is a renowned trader and financial strategist known for his practical approaches to trading. With years of experience, he has developed methods tailored to meet the needs of those with tight schedules.

Contributions to the Trading Community

Kere’s strategies focus on simplicity and efficiency, making trading accessible to everyone. His work has helped many busy professionals successfully navigate the complexities of the financial markets.

Understanding the Basics of Trading

What is Trading?

Trading involves buying and selling financial instruments like stocks, bonds, or currencies with the aim of making a profit. It requires knowledge, strategy, and a keen eye for market trends.

Types of Trading

- Day Trading: Buying and selling securities within the same day.

- Swing Trading: Holding positions for several days to weeks.

- Position Trading: Long-term trading based on comprehensive analysis.

The Challenges of Trading for Busy People

Time Constraints

Busy schedules make it difficult to monitor markets constantly. Kere’s strategies address this by focusing on time-efficient trading methods.

Information Overload

The vast amount of information available can be overwhelming. Kere emphasizes the importance of filtering and prioritizing relevant data.

Josias Kere’s Trading Strategies

Simplifying the Process

Kere advocates for simplifying trading processes to make them manageable for busy individuals. This involves focusing on key indicators and avoiding unnecessary complexities.

Leveraging Technology

Using technology effectively can save time and enhance trading efficiency. Kere recommends using trading apps, automated alerts, and other tools to stay updated.

Risk Management

Effective risk management is crucial. Kere emphasizes setting stop-loss orders and diversifying investments to minimize potential losses.

Practical Tips for Busy Traders

Setting Clear Goals

Define your trading objectives. Are you looking for short-term gains or long-term growth? Clear goals help streamline the trading process.

Developing a Routine

Establish a trading routine that fits into your schedule. This could involve dedicating specific times of the day to review and manage your trades.

Utilizing Automated Trading

Automated trading systems can execute trades based on predefined criteria, freeing up your time while ensuring your strategies are implemented.

Tools and Resources

Trading Platforms

Choosing the right trading platform is essential. Kere suggests platforms that offer robust features, user-friendly interfaces, and reliable customer support.

Educational Resources

Continuous learning is key. Utilize online courses, webinars, and books to stay informed about market trends and trading strategies.

Financial News Apps

Stay updated with the latest market news using financial news apps. These apps provide real-time updates and analysis, helping you make informed decisions.

Case Studies

Successful Busy Traders

Kere shares examples of busy professionals who have successfully implemented his strategies. These case studies provide practical insights and inspiration.

Lessons Learned

Analyzing past successes and failures helps refine trading strategies. Kere’s work includes valuable lessons from real-life trading experiences.

Conclusion

Josias Kere’s approach to trading for busy people offers a practical and efficient way to engage in the financial markets. By simplifying processes, leveraging technology, and focusing on key strategies, busy individuals can successfully navigate trading without overwhelming their schedules.

FAQs

1. Who is Josias Kere?

Josias Kere is a renowned trader and financial strategist known for his practical trading methods tailored to busy individuals.

2. What is swing trading?

Swing trading involves holding positions for several days to weeks, allowing traders to capitalize on market fluctuations.

3. How can technology aid in trading?

Technology offers tools like trading apps and automated alerts that help busy traders stay updated and manage their trades efficiently.

4. What is a stop-loss order?

A stop-loss order is a risk management tool that automatically sells a security when it reaches a predetermined price, limiting potential losses.

5. Why is continuous learning important in trading?

The financial markets are constantly evolving, and continuous learning helps traders stay informed about new trends and strategies.

Be the first to review “Trading For Busy People with Josias Kere” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.