Trading Triggers – The Secrets to Profitable Trading with John Person

$289.00 Original price was: $289.00.$6.00Current price is: $6.00.

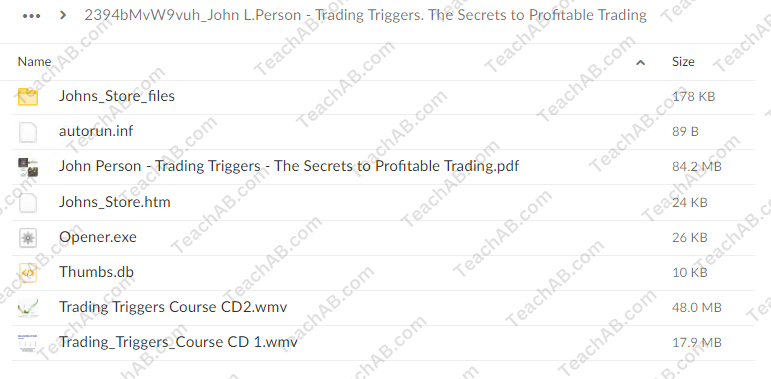

File Size: 150.3 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Trading Triggers – The Secrets to Profitable Trading with John Person” below:

Trading Triggers – The Secrets to Profitable Trading with John Person

Introduction

Welcome to the world of profitable trading with John Person’s Trading Triggers. This comprehensive guide will unravel the secrets to effective trading, leveraging John Person’s renowned strategies. Whether you’re a novice or an experienced trader, this article will provide valuable insights into maximizing your trading potential.

Who is John Person?

Background and Expertise

John Person is a seasoned trader, author, and educator with over 30 years of experience in the financial markets. He is widely recognized for his innovative trading systems and has authored several books on trading strategies.

Contributions to Trading

- Innovative Strategies: Developed unique trading methods that have become industry standards.

- Educational Influence: A prominent figure in trader education through books, seminars, and webinars.

What are Trading Triggers?

Definition and Overview

Trading triggers are specific conditions or signals that prompt a trader to enter or exit a trade. These triggers are based on technical analysis, market patterns, and other indicators.

Importance of Trading Triggers

- Precision: Help in making precise entry and exit decisions.

- Consistency: Ensure consistent application of trading strategies.

- Risk Management: Aid in managing and minimizing risk.

Core Concepts of John Person’s Trading Triggers

Pivot Points

Understanding Pivot Points

Pivot points are significant levels calculated using the high, low, and close prices of a previous period. They help identify potential support and resistance levels.

Using Pivot Points in Trading

- Entry Points: Enter trades near support or resistance levels identified by pivot points.

- Exit Points: Use pivot points to determine optimal exit levels.

Candlestick Patterns

Importance of Candlestick Patterns

Candlestick patterns provide visual insights into market sentiment and potential price reversals.

Key Candlestick Patterns

- Doji: Indicates market indecision and potential reversal.

- Hammer: Suggests a bullish reversal after a downtrend.

- Engulfing Patterns: Signal strong reversals when a smaller candle is followed by a larger one that engulfs it.

Technical Indicators

Relative Strength Index (RSI)

RSI measures the speed and change of price movements, helping identify overbought or oversold conditions.

Moving Averages

Moving averages smooth out price data to identify trends and potential reversal points.

Developing a Trading Plan with Trading Triggers

Setting Clear Objectives

Defining Goals

Set specific, measurable, achievable, relevant, and time-bound (SMART) goals for your trading activities.

Risk Tolerance

Determine your risk tolerance and adjust your trading strategies accordingly.

Identifying Trading Triggers

Combining Indicators

Use a combination of pivot points, candlestick patterns, and technical indicators to identify reliable trading triggers.

Entry and Exit Rules

Establish clear entry and exit rules based on your identified triggers to maintain consistency.

Executing Trades

Implementing Your Trading Plan

Order Types

- Market Orders: Execute trades immediately at the current market price.

- Limit Orders: Set specific prices at which you want to buy or sell an asset.

Position Sizing

Determine the size of your trade positions to manage risk effectively.

Monitoring and Adjusting

Trade Monitoring

Keep a close watch on your trades and market conditions to make necessary adjustments.

Adjusting Strategies

Be prepared to adjust your strategies based on market changes and new information.

Risk Management with Trading Triggers

Stop-Loss Orders

Setting Stop-Loss Levels

Use stop-loss orders to limit potential losses by exiting trades at predetermined price levels.

Trailing Stops

Implement trailing stops to protect profits by moving the stop-loss level as the market price moves in your favor.

Position Sizing

Calculating Position Size

Use position sizing techniques to determine the appropriate amount of capital to risk on each trade.

Diversification

Diversify your trades across different assets to spread risk.

Advanced Strategies with Trading Triggers

Backtesting Strategies

Historical Data Analysis

Test your trading strategies using historical data to evaluate their effectiveness.

Refining Strategies

Continuously refine your strategies based on backtesting results and market feedback.

Automating Trading

Trading Bots

Implement trading bots to automate your strategies and execute trades based on predefined triggers.

Algorithmic Trading

Develop algorithms to trade based on complex strategies and multiple indicators.

Common Mistakes to Avoid

Overtrading

Avoid the temptation to trade too frequently. Focus on quality trades rather than quantity.

Ignoring Risk Management

Always implement risk management techniques to protect your capital.

Lack of Discipline

Stick to your trading plan and avoid making impulsive decisions based on emotions.

Benefits of Using Trading Triggers

Consistency

Ensure consistent application of your trading strategies by relying on specific triggers.

Improved Decision-Making

Enhance your decision-making process with clear entry and exit signals.

Reduced Emotional Trading

Minimize emotional trading by following predefined triggers and strategies.

Conclusion

Trading triggers, as taught by John Person, offer a structured and effective approach to trading. By understanding and implementing these triggers, you can enhance your trading performance, manage risks effectively, and achieve consistent profits. Start incorporating trading triggers into your strategy today and unlock the secrets to profitable trading.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Trading Triggers – The Secrets to Profitable Trading with John Person” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

Reviews

There are no reviews yet.