Using Fundamental Analysis with Andrew Baxter

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

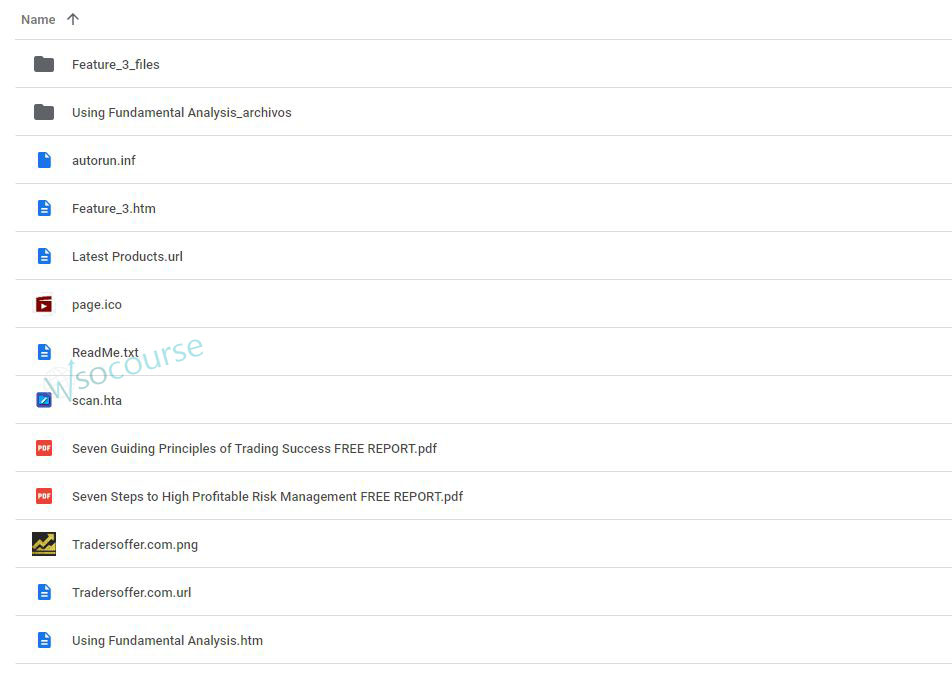

Content Proof: Watch Here!

You may check content proof of “Using Fundamental Analysis with Andrew Baxter” below:

Using Fundamental Analysis with Andrew Baxter

Introduction to Fundamental Analysis

In the world of investing, understanding the true value of an asset is crucial. Fundamental analysis is a method used to evaluate a security’s intrinsic value by examining related economic, financial, and other qualitative and quantitative factors. Andrew Baxter, a seasoned expert in this field, provides profound insights into utilizing fundamental analysis effectively. Let’s explore the key principles and techniques that underpin this approach.

What is Fundamental Analysis?

Defining Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health and performance by analyzing financial statements, industry trends, and economic indicators. This method helps investors determine whether a stock is undervalued or overvalued.

The Importance of Fundamental Analysis

Understanding the fundamentals of a company allows investors to make informed decisions, reducing the risk of losses and increasing the potential for gains. It’s a comprehensive approach that goes beyond mere price movements.

Key Components of Fundamental Analysis

1. Financial Statements

Analyzing financial statements is the backbone of fundamental analysis. This includes the balance sheet, income statement, and cash flow statement.

Balance Sheet

The balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity. It’s essential for assessing the company’s financial stability.

Income Statement

The income statement shows the company’s revenue, expenses, and profits over a specific period. It helps in evaluating profitability and growth potential.

Cash Flow Statement

The cash flow statement tracks the flow of cash in and out of the company. It’s crucial for understanding liquidity and cash management.

2. Economic Indicators

Economic indicators like GDP growth, inflation rates, and unemployment levels impact a company’s performance. These macroeconomic factors provide context for the company’s financial health.

3. Industry Analysis

Understanding industry trends and the competitive landscape is vital. This analysis helps in identifying opportunities and threats that could affect the company’s future performance.

Andrew Baxter’s Approach to Fundamental Analysis

Experience and Expertise

Andrew Baxter brings extensive experience in financial markets and a deep understanding of fundamental analysis. His approach is both systematic and practical, making it accessible to both novice and seasoned investors.

Key Principles

Baxter emphasizes thorough research, continuous learning, and disciplined investing. His approach integrates both qualitative and quantitative analysis for a holistic view of a company’s value.

Steps to Perform Fundamental Analysis

1. Gather Financial Information

Collecting accurate and comprehensive financial information is the first step. Utilize reliable sources such as company reports, financial news, and databases.

2. Analyze Financial Statements

Evaluate the balance sheet, income statement, and cash flow statement. Look for trends in revenue growth, profitability, and cash flow.

3. Examine Economic Indicators

Assess the macroeconomic environment and how it affects the company. Consider factors like economic growth, interest rates, and inflation.

4. Conduct Industry Analysis

Analyze the industry in which the company operates. Identify key competitors, market trends, and potential disruptors.

5. Calculate Financial Ratios

Financial ratios such as P/E ratio, debt-to-equity ratio, and return on equity (ROE) provide insights into the company’s performance and valuation.

Advanced Techniques in Fundamental Analysis

1. Discounted Cash Flow (DCF) Analysis

DCF analysis involves estimating the present value of future cash flows. This technique helps in determining the intrinsic value of a company.

2. Comparative Analysis

Compare the company with its peers. This relative valuation method helps in understanding the company’s market position.

3. SWOT Analysis

SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) provides a strategic view of the company’s potential and challenges.

Common Mistakes to Avoid

1. Ignoring Macroeconomic Factors

Overlooking the broader economic environment can lead to inaccurate valuations. Always consider macroeconomic trends and indicators.

2. Overreliance on Financial Ratios

While financial ratios are important, they should not be the sole basis for investment decisions. Integrate qualitative analysis for a balanced view.

3. Short-Term Focus

Fundamental analysis is best suited for long-term investing. Avoid making decisions based on short-term market fluctuations.

Benefits of Fundamental Analysis

1. Informed Decision-Making

Fundamental analysis provides a solid foundation for making informed investment decisions. It reduces reliance on market speculation.

2. Long-Term Perspective

This approach promotes a long-term investment perspective, aligning with the intrinsic value of the company rather than short-term market movements.

3. Risk Mitigation

By understanding a company’s financial health and market position, investors can better manage risks and avoid potential pitfalls.

Conclusion

Using fundamental analysis with insights from Andrew Baxter offers a robust framework for evaluating investments. By focusing on financial health, economic indicators, and industry trends, investors can make well-informed decisions that align with their long-term financial goals. Embrace these principles, and let fundamental analysis guide your investment journey.

Frequently Asked Questions:

What is fundamental analysis?

Fundamental analysis is a method of evaluating a security’s intrinsic value by examining financial statements, economic indicators, and industry trends.

Why is fundamental analysis important?

It helps investors make informed decisions, reducing risk and increasing potential gains by understanding a company’s true value.

What are the key components of fundamental analysis?

Key components include financial statements, economic indicators, and industry analysis.

How does Andrew Baxter approach fundamental analysis?

Andrew Baxter emphasizes thorough research, continuous learning, and disciplined investing, integrating both qualitative and quantitative analysis.

What are some common mistakes to avoid in fundamental analysis?

Avoid ignoring macroeconomic factors, overrelying on financial ratios, and focusing too much on short-term market movements.

Be the first to review “Using Fundamental Analysis with Andrew Baxter” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.