Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

$89.00 Original price was: $89.00.$6.00Current price is: $6.00.

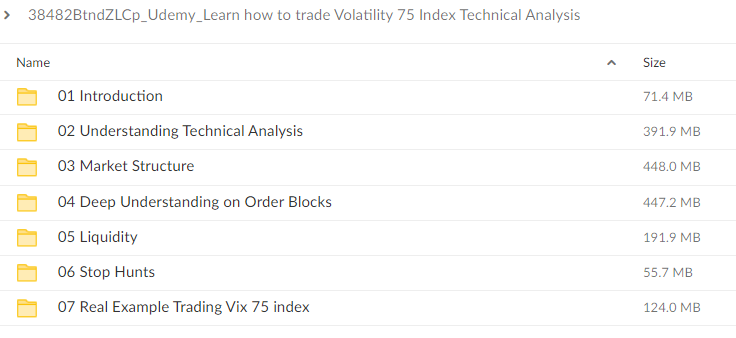

File Size: 1.69 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke” below:

Learn How to Trade Volatility 75 Index Technical Analysis with Patrick Muke

Introduction

The Volatility 75 Index, often referred to as VIX 75, is a measure of market volatility and has become a favorite among traders who thrive on rapid market movements. Patrick Muke, a renowned expert in technical analysis, has developed specific strategies that help traders navigate the complexities of this volatile index. This article will guide you through the fundamentals of trading VIX 75 using technical analysis as taught by Patrick Muke.

Understanding the Volatility 75 Index

Before diving into the strategies, it’s crucial to understand what VIX 75 represents and why it is a significant tool for market predictions.

What is the Volatility 75 Index?

- Definition: VIX 75 measures the market’s expectation of volatility over the coming 30 days.

- Importance: It is often called the “fear gauge” because it typically increases when market sentiment is poor.

Characteristics of VIX 75

- High Volatility: This index is particularly volatile, which can lead to significant trading opportunities.

- Non-directional: It measures volatility, not direction, making it unique compared to other financial indices.

Patrick Muke’s Approach to VIX 75

Patrick Muke emphasizes a disciplined approach to trading the VIX 75, using technical analysis to make informed decisions.

Core Principles of Muke’s Strategy

- Technical Indicators: Focuses on indicators that are best suited for volatile markets.

- Risk Management: Prioritizes strategies to minimize losses in a highly unpredictable market.

Technical Analysis Tools for VIX 75

Choosing the Right Indicators

- Relative Strength Index (RSI): Determines overbought or oversold conditions.

- Moving Averages: Helps identify trends.

Chart Patterns

- Breakouts: Indicates significant moves that could suggest entry or exit points.

- Reversals: Helps predict changes in the current trend.

Setting Up Your Trading Platform

To effectively trade VIX 75, you need a trading platform that supports real-time data and advanced charting capabilities.

Features to Look For

- Real-Time Data: Essential for keeping up with rapid changes.

- Customizable Indicators: Allows for personal adjustments based on Muke’s recommendations.

Developing a Trading Plan

Establishing Entry and Exit Points

- Entry Points: Based on specific signals from chosen indicators.

- Exit Points: Determined by predefined profit targets and stop-loss orders.

Risk Management Techniques

- Position Sizing: Determines how much capital to risk on a single trade.

- Stop-Loss Orders: Critical for limiting potential losses.

Common Mistakes to Avoid

Overtrading

- Symptoms: Excessive trading that can lead to quick depletion of capital.

- Prevention: Set strict trading limits and adhere to them.

Ignoring Market News

- Impact: News can drastically affect market volatility.

- Strategy: Stay informed and be ready to adjust your trading plan.

The Psychological Aspect of Trading VIX 75

Stress Management

- Techniques: Regular breaks, meditation, and maintaining a balanced lifestyle.

Maintaining Discipline

- Importance: Consistency in following your trading plan is key to long-term success.

Patrick Muke’s Insights on Market Trends

Understanding Market Sentiment

- Tools: Use of sentiment analysis to gauge market mood.

Adapting to Market Changes

- Flexibility: How to adjust your strategies based on new information.

Real-World Examples of Successful Trades

Illustrating successful trades can provide practical insights and boost confidence in applying these strategies.

Conclusion

Trading the Volatility 75 Index using technical analysis is a challenging yet rewarding endeavor. With the guidance of Patrick Muke, traders can develop the necessary skills to navigate this complex market effectively. By adhering to a disciplined approach and continuously refining your strategies, you can enhance your trading proficiency and potentially increase your profitability.

FAQs

- What is the Volatility 75 Index?

- It is an index measuring the market’s expectation of volatility over the next 30 days.

- Why is VIX 75 known as the ‘fear gauge’?

- Because it tends to rise when market sentiment is negative, indicating increased fear.

- What are key indicators for trading VIX 75?

- Key indicators include the Relative Strength Index (RSI) and Moving Averages.

- How important is risk management in trading VIX 75?

- It is crucial due to the index’s high volatility, making risk management essential to protect against large losses.

- Can beginners trade VIX 75 successfully?

- Yes, but with careful study and adherence to sound trading strategies and risk management principles.

Be the first to review “Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke” Cancel reply

You must be logged in to post a review.

Related products

Others

Others

Others

Reviews

There are no reviews yet.